A Total-Package Offering Inside the APP Annuity

The APP annuity is rich in performance-based features that are designed to be a strong addition to any agent portfolio or client plan.

5% Premium Bonus

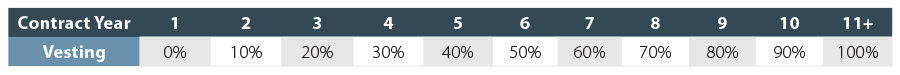

Policyholders will receive a one-time premium bonus of 5% with or without the selection of the Rate Enhancement Rider! The premium bonus is immediately credited to your account, increasing the value of your account and giving you the opportunity to earn additional interest. Premium Bonus is subject to a vesting schedule.

Same Great Guarantees

Participation rates are guaranteed for 10 years1 from the annuity issue date with the selection of the Momentum Index and Diversified Macro 5 Index 1- and 2-year point-to-point crediting strategies! These guarantees help build confidence by locking in rates for ten years, avoiding renewal rate uncertainty, unexpected rate decreases, and gives more reliability in the strategy because it will deliver on its promises.

Consistent Rate History

APP annuity rates have steadily increased since launch across all strategy options. This is backed by our Rate Integrity Philosophy.

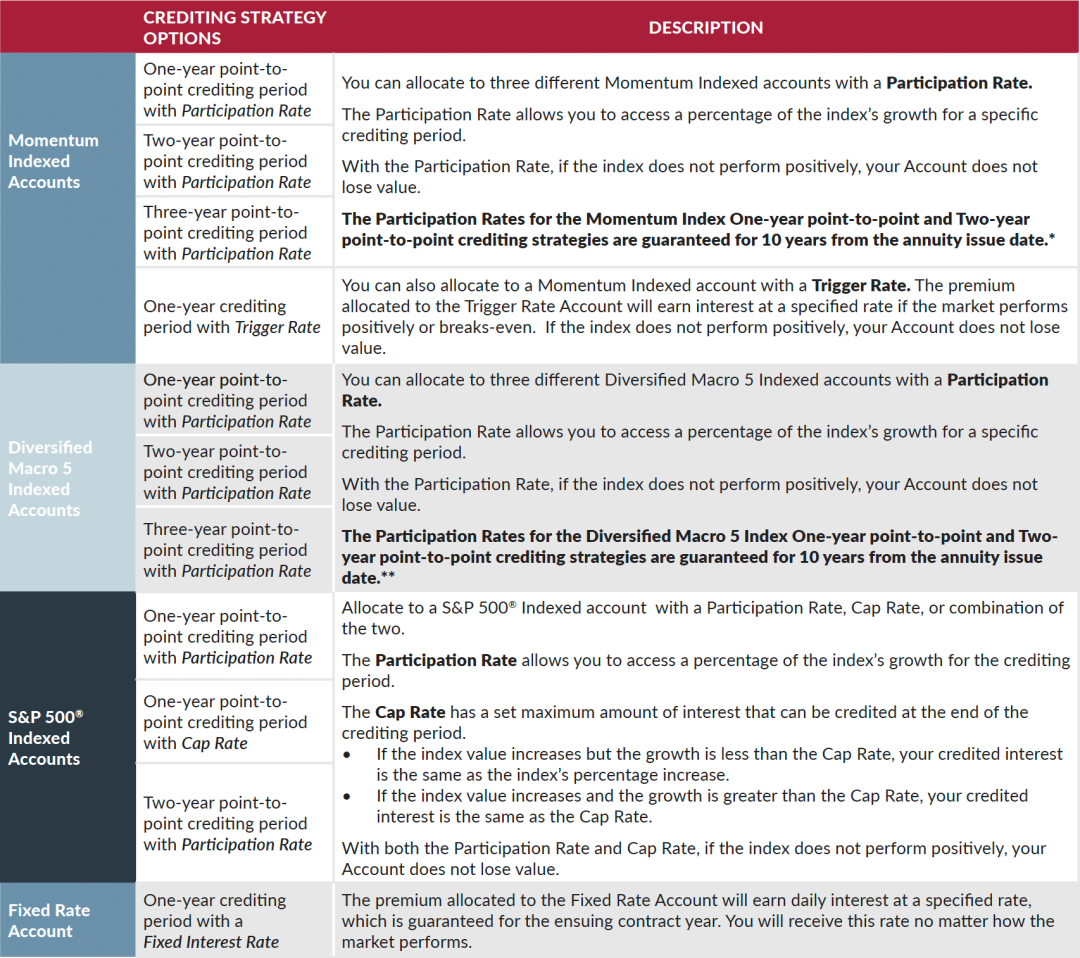

Flexible Crediting Strategies

Multiple index strategy options, a fixed rate, trigger rate, and cap rate are available to choose from for accumulation needs. Ten indexed accounts are linked to three different indices, the Momentum Index, Diversified Macro 5 Index, and the S&P 500®.

Additionally, an optional Rate Enhancement Rider is available to add more value.

1 The Participation Rates for the Momentum Index One-year point-to-point and Two-year point-to-point crediting strategies are guaranteed for 10 years from the annuity issue date, provided that Sentinel Security Life Insurance Company continues to have access to the Momentum Index. The Participation Rates for the Diversified Macro 5 Index One-year point-to-point and Two-year point-to-point crediting strategies are guaranteed for 10 years from the annuity issue date, provided that Sentinel Security Life Insurance Company continues to have access to the Diversified Macro 5 Index.

Choose from Eleven Growth Strategies

Choose how the annuity premium is allocated across eleven crediting strategies. These crediting strategies include a Fixed Account and ten Indexed Accounts linked to three indices, the Momentum Index, the Diversified Macro 5 Index, and the S&P 500® Index.

Adjust allocations on the contract anniversary that coincides with the end of each strategy’s crediting period. At that time, the option to allocate to any available strategy for a new crediting period of one, two or three years is available.

Did you know? The APP annuity’s Trigger Rate may be a good alternative for clients considering Fixed Rate allocations.

How the Trigger Rate works: if the Momentum Index earns 0% or more, then the premium allocated to the Trigger Rate account will earn interest at a specified rate of 9% for the base product and 11% with the rider.

So, the benefit of the Trigger Rate is that it earns a higher rate than as long as the Momentum Index breaks even or earns a positive return.

Optional Rate Enhancement Rider

An optional Rate Enhancement Rider2 offers more benefits to policyholders:

- Higher Rate Options: higher Participation, Cap, Trigger, and Fixed Rates for more growth potential.

- More Liquidity: Increases the free withdrawal amount to 10%, after the first contract year.

- Pricing Guarantee: 110% Return of Premium (ROP) Guarantee if the Rate Enhancement Rider is purchased and the contract remains in force for 10 years. Please note: premium is adjusted for withdrawals.

2 There is a fee with the purchase of the rider.

Accumulation with Accessibility

Free withdrawals

Some annuities do not offer free early withdrawals, but in the second contract year, the APP annuity allows clients to withdraw up to 5% of their Account Value or Required Minimum Distribution, whichever greater.

Terminal Illness and Nursing Home Waiver

If the annuity owner is diagnosed with a terminal illness or needs to move into a nursing home, he or she can make a full surrender or partial withdrawal without a Market Value Adjustment, Surrender Charge, or loss of any applicable Non-Vested Premium Bonus under certain conditions.

Additional Features

Premium Bonus Vesting Schedule

When your client purchases the Accumulation Protector PlusSM Annuity they will receive a one-time premium bonus of 5%. The premium bonus is immediately credited to the policyholder’s account, increasing the value of their account and giving them the opportunity to earn additional interest. The policyholder’s funds can be accessed subject to their vesting schedule.

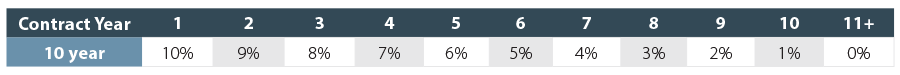

Surrender Charge Schedule

If your client surrenders their policy or requests withdrawals above the penalty-free amount, there may be surrender charges. Policyholders should discuss the surrender charge schedule with their agent.

Death Benefit Settlement Option

Protect loved ones with the APP’s Death Benefit feature. If the annuity owner passes away before receiving any proceeds3, other than a Withdrawal, the amount payable to beneficiary(ies) is equal to the greater of the Account Value less any Non-Vested Premium Bonus or the Minimum Guaranteed Surrender Value determined as of the date of death.

3Proceeds are defined as the amount payable when: (1) the Owner takes a Withdrawal; (2) the Owner surrenders their Contract; (3) an Owner dies; or (4) the Contract matures.

Product Sites

Quick Links

For Sentinel Security Life Insurance Company-Licensed Agent Use Only.

All product recommendations must be prioritized by the consumer’s best interest.

This website is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Please be aware that any unauthorized review; copying, use, disclosure or distribution of this information is prohibited.

The “S&P 500® ” is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by Sentinel Security Life Insurance Company. Standard & Poor’s® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Sentinel Security Life Insurance Company. Accumulation Protector PlusSM Annuity is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P® , or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500® .

The Momentum Index and Diversified Macro 5 Index are volatility-controlled indexes that may include a fee in the computation of the index value.

Neither MerQube, Inc. nor any of its affiliates (collectively, “MerQube”) is the issuer or producer of Accumulation Protector PlusSM Annuity and MerQube has no duties, responsibilities, or obligations to investors in Accumulation Protector PlusSM Annuity. The index underlying the Accumulation Protector PlusSM Annuity is a product of MerQube and has been licensed for use by Sentinel Security Life Insurance Company. Such index is calculated using, among other things, market data or other information (“Input Data”) from one or more sources (each a “Data Provider”). MerQube® is a registered trademark of MerQube, Inc. These trademarks have been licensed for certain purposes by Sentinel Security Life Insurance Company in its capacity as the issuer of the Accumulation Protector PlusSM Annuity. Accumulation Protector PlusSM Annuity is not sponsored, endorsed, sold or promoted by MerQube, any Data Provider, or any other third party, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Input Data, Diversified Macro 5 Index or any associated data.

The Momentum Index, (the “Index”), and any trademarks, service marks and logos related thereto are service marks of Solactive AG (“Solactive”). Solactive has no relationship to Sentinel Security Life Insurance Company, other than the licensing of the Momentum Index and its service marks for use in connection with the Accumulation Protector PlusSM Annuity and is not a party to any transaction contemplated hereby. The Accumulation Protector PlusSM Annuity is not sponsored, endorsed, or promoted by Solactive in any way and Solactive makes no express or implied representation, guarantee or assurance regarding the quality, accuracy and/or completeness of the Index, and the results obtained or to be obtained by any person or entity from the use of the Index. Solactive reserves the right to change the methods of calculation or publication with respect to the Index. Solactive shall not be liable for any damages suffered or incurred because of the use (or inability to use) of the Index. Solactive shall not be liable for the results obtained by using, investing in, or trading the Accumulation Protector PlusSM Annuity. Solactive has not created, published, or approved this document and accepts no responsibility or liability for its contents or use. Obligations to make payments under the Accumulation Protector PlusSM Annuity are solely the obligation of Sentinel Security Life Insurance Company and are not the responsibility of Solactive.

For Sentinel-Licensed Agents Only